Key takeaways

The need for aged care can be sudden, often triggered by unexpected changes in health. Also, it can be an uncertain and overwhelming experience for you and your family.

Without preparation, a move into aged care can cause great emotional and financial strain. So, what can you do for yourself and your loved one to be better prepared? We look at some of the key decisions to consider to help you plan ahead and get ready.

Types of aged care

There are three main types of aged care.

Help at home: if your relative prefers to live independently, they can receive care at their home (or a retirement village) when needed. This may include help with personal care needs such as showering and cooking meals, medical care, or other domestic support, such as home maintenance.

Short term care: may be required after a hospital stay or if the regular carer is taking a holiday

Aged care home: supplemented accommodation with 24-hour care available. Can be short term or permanent.

Moving into aged care: seek help

Aged care is a complex area that requires a solid understanding of how the rules interact with the broader tax and social security system. We therefore suggest you talk to a financial coach with expertise in this area.

A financial coach can help you to:

-

manage costs

-

review entitlements to social security benefits

-

choose suitable investments, and

-

plan for the distribution of your estate.

A financial coach can help you maximise your financial position and take a lot of stress out of what can be an emotional transition point in your life.

Moving into aged care: the process

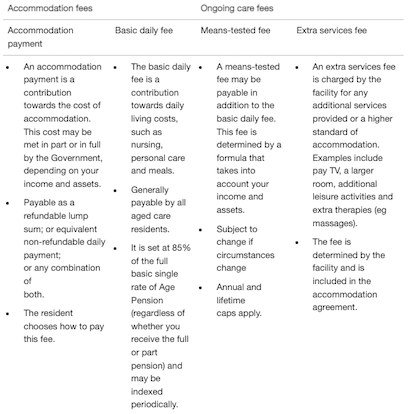

There are four fees that may be payable when residing in a Government subsidised aged care facility. The below table provides a general summary of what you or your relative might be expected to pay.

If your relative decides moving into aged care is the right move, there are steps required to get the process in motion.

1. Have their needs assessed

To be eligible for Government subsidies, a person must be assessed by a member of the Aged Care Assessment Team (ACAT). This assessment is free and can be done at home, a health centre or hospital.

The ACAT member will ask them a series of questions about their health, mobility and any help that they currently receive at home, to determine whether residential aged care is required based on their needs

2. Find an aged care home

Once ACAT approval is received, you can start looking for relevant accommodation. When evaluating aged care home options, it’s worth contacting a selection of providers to get a better comparison.

If you’re unsure about the facilities and rooms available in a particular area, you can find out more information by visiting myagedcare.gov.au.

It may be beneficial to have a list of questions prepared to ensure you receive the information you need.

These questions may include:

-

What kinds of recreational activities are offered?

-

Are the available rooms shared or single rooms, and is there a private ensuite?

-

What types of other services are regularly provided (such as physio or hairdressing services for example)?

-

What food and beverage options are available?

-

Will your relative have access to a phone, internet or mobile phone to contact you?

-

Ask to see a brief report of the Health and Safety report. This is a good indicator with regards to, not only incidents that have taken place, but also incidents against residents and incidents of residents against staff.

Understanding your rights and responsibilities as well as those of the service provider will help you make an informed decision and get the best quality care to suit your relative’s needs.

3. Work out the costs of moving into aged care

There are a number of fees that may be payable when residing in a Government subsidised aged care facility. The below table provides a general summary of what you or your relative might be expected to pay.

Note: The following fees apply to Government approved and subsidised residential care facilities which are governed by the relevant legislation. Fees applicable for private aged care facilities are not governed by legislation and are not subsidised by the Government. It is recommended you speak to individual private aged care facilities to understand their pricing structure.

4. Apply for an aged home

Generally, multiple applications can be submitted when applying for an aged care home and you may have the ability to be placed on a waiting list.

You will be asked if you want to provide details of your relative’s income and assets but you are not legally required to disclose this.

5. Moving your relative into aged care

Just before they move in, you’ll be provided with an Accommodation Agreement. This is a legal document which sets out the terms of the residency as well as rights and responsibilities for your relative and for the aged care facility. You may want to consider seeking legal advice before signing it.

When your relative does move into an aged care home, don’t forget to notify Services Australia (Centrelink) about their new living situation and any other change in circumstances (e.g. sale of their home, assets used to pay lump sum costs).

Other things to consider

Estate planning

Often, we assume estate planning simply involves making it clear in a Will who we would like to inherit assets when we pass away. However, while a Will can help ensure your estate is distributed according to your wishes, it may not be effective in dealing with a significant portion of your wealth.

For example, the proceeds from superannuation funds and life insurance policies don’t automatically form part of your estate, which means that addressing these investments in your Will may be ineffective unless you take some important additional steps.

A well-prepared and executed estate plan can ensure that your wishes are carried out so that the right assets go to the right people at the right time, in an efficient and tax-effective manner.

It can also ensure that if you’re unable to make important financial and lifestyle decisions for yourself, the right person of your choice is able to step in on your behalf.

View this Guide to planning your estate, which outlines the key tools and strategies you could use to achieve your estate planning objectives.

Contact us on (07) 4041 6777 to find out more.

Important information and disclaimer

This article has been prepared by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 (NULIS) as trustee of the MLC Super Fund ABN 70 732 426 024. NULIS is part of the group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (‘Insignia Financial Group’). The information in this article is current as at December 2022 and may be subject to change. This information may constitute general advice. The information in this article is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider obtaining independent advice before making any financial decisions based on this information. You should not rely on this article to determine your personal tax obligations. Please consult a registered tax agent for this purpose. Opinions constitute our judgement at the time of issue. The case study examples (if any) provided in this article have been included for illustrative purposes only and should not be relied upon for decision making. Subject to terms implied by law and which cannot be excluded, neither NULIS nor any member of the Insignia Financial Group accept responsibility for any loss or liability incurred by you in respect of any error, omission or misrepresentation in the information in this communication.