The “painful squeeze” for Australian consumers

Australians are experiencing tough times. Every trip to the supermarket leaves us leaner and poorer in terms of our purchasing power. The $20 note barely covers a bottle of milk, a loaf of bread and a carton of eggs.

When you arrive home, you are afraid to switch on the heater and lights given the costs. For many, the cheaper and safer choice is to crawl into bed early, pull the blanket over and then try to dream of better days ahead.

High inflation is clearly a global problem. Yet Australia’s inflation has local consequences. The consumer has become very cautious in spending because our budgets are stretched to breaking point. This has implications for Australia’s economy, house and share prices as well as our health and wellbeing.

Our central bank, the Reserve Bank of Australia (RBA), seems aware of these challenges. The RBA Governor noted in June that the “combination of higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending … some households have substantial savings buffers, although others are experiencing a painful squeeze on their finances.”

However, the question needs to be asked: Is the RBA mindful of how dramatic this “painful squeeze” really is? Some fortunate few may have “savings buffers”, but the “others” are many and rapidly growing in numbers.

Everything is going up except our confidence

The Consumer Price Index (CPI) displays these painful price pressures (Chart 1). In the year to April, electricity prices have risen by 15.2%, food products by 11.7% and rents by 6.1% according to the Australian Bureau of Statistics (ABS)1. Yet this data does not fully reflect the reality on the ground. Given the delays in capturing new rentals which are rising at a +10% annual pace according to CoreLogic, the reality is that renters are being hit hard. Notably 31% of Australian households are renters – so this rental squeeze impact is hardly just “some” households.2

Chart 1 – Australia’s painful price pressures

Source: ABS.

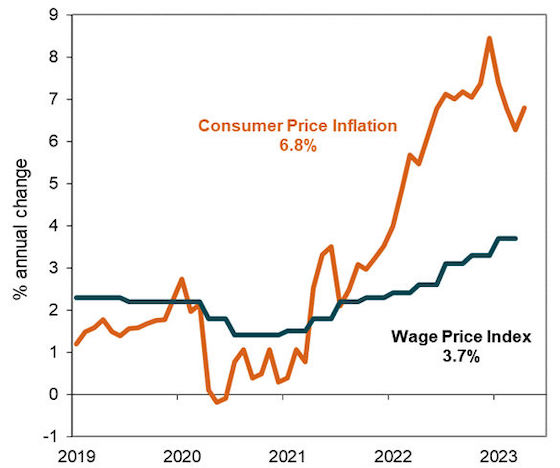

The ‘painful squeeze’ is also evidenced by the wide gap between Australia’s CPI inflation rate at 6.8% and wages growth running at 3.7% in the year to March (Chart 2). Effectively worker’s wages have failed to keep pace with inflation. This ‘inflation – wages gap’ has been the reality for the past two years. The toil of work has provided little compensation for the reality of higher consumer prices. Admittedly a 5.75% increase in award wages was announced on 2 June, which applies for the coming financial year3. However, this award wage rise only directly benefits ‘some’ 20% of the workforce. Even so, rising wages have not fully compensated for the recent inflation experience. Hence the ‘wage slave’ status still applies for all too many.

Chart 2 – Australia’s inflation rate vs wages growth

Source: ABS.

The RBA continues to turn the vice by pushing interest rates higher

The RBA is just one of many central banks such as the US and European central banks to aggressively raise cash interest rates to curb inflation. The RBA’s cash interest rate has risen from 0.1% to 4.1% in the past year. Hence another price being paid for higher inflation is rising housing interest rates. The direct impact is that Australia’s variable mortgage rate has more than doubled from 2.9% to circa 7% for ‘owner occupiers’ (Chart 3). Similar pain has been felt by investors with housing loans.

For now, ‘some’ fortunate fixed rate borrowers who borrowed at the available 2% interest rate back around 2021 have been insulated from rising interest rates. However, these fixed loans are approaching their ‘use by date’, so these borrowers face a ‘sticker shock’ of moving either to a 6% fixed or 7% variable rate. Effectively this is known as the ‘mortgage cliff’ as fixed rate borrower’s budgets plunge into an abyss.

Chart 3 – Australia’s cash interest rate vs home loan rates

Source: RBA.

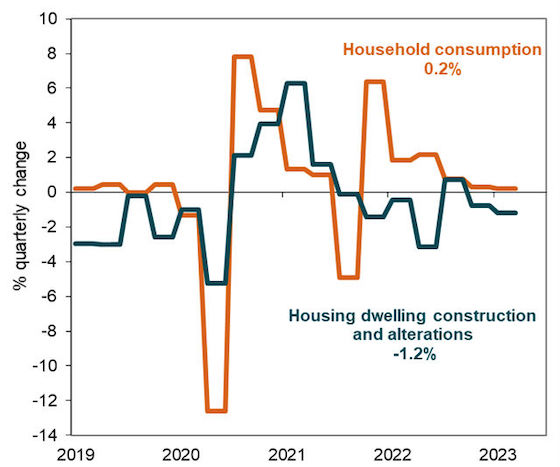

This ‘painful squeeze’ of higher interest rates is exacting a toll on consumer spending and housing construction. The most recent National Accounts showed that household consumption spending barely increased by only 0.2% in the March quarter while housing construction and alterations fell by -1.2% (Chart 4)4. Consumers are reducing demand for goods and services as well as housing because of the squeeze on purchasing power. The savings rate for households has fallen to 3.7%, the lowest since June 2008. There is also angst to come with further price rises. The proposed +20% lift in electricity prices in the new financial year will further challenge our budgets on whether to keep the lights on and the heater going.

Chart 4 – Australia’s GDP spending components

Source: ABS.

For the broader Australian economy, this challenging mix of high inflation and rising interest rates on the consumer suggests that the Australian economy will struggle over the next year.

Are there any hopeful signs?

There is some good news even amidst these difficult times. Firstly, the jobs market remains remarkably strong with solid jobs growth and high vacancies. This suggests that some workers have the bargaining power to negotiate higher wages, more working hours or even both. The spectre of underemployment – where part-time workers could not get sufficient hours – is essentially at a 15 year low of 6.1%. Unemployment at 3.7% is also at multi-decade lows.5

Secondly, the Federal Government’s Budget is on a path to record its first surplus in 15 years. While this may be a temporary windfall given the strong jobs market and commodity prices, this does give the Federal Government more scope to alleviate the pain of high inflation and interest rates. More government support measures for low-income households are clearly needed as noted by the Australian Council of Social Service.6

Finally, our financial challenges can be made more tolerable by focusing on family and friends rather than the ebbs and outflows of our bank accounts. Our dinners may feature more of the cheaper cuts of meat and vegetables as well as the occasional wine – but this can be more than made up for by spending more time on conversations rather than crying into your pretzels7.

If you need help with your finances, call us today.

Source: MLC

References

1 Monthly Consumer Price Index Indicator, April 2023 | Australian Bureau of Statistics (abs.gov.au).

2 Housing Occupancy and Costs, May 2022 | Australian Bureau of Statistics (abs.gov.au).

3 Australia’s minimum wage jumps by 8.6 per cent, award workers get 5.75 per cent pay boost, Hutchens, G & Chalmers, S, ABC News, 2 June 2023.

5 Labour Force Australia, April 2023, Australian Bureau of Statistics (abs.gov.au).

6 ‘Governments must do more to provide relief to people on low incomes struggling with the cost of energy bills’. Australian Council of Social Service, Media release, May 25, 2023.

7 “Soggy Pretzels” lyrics, Neil Diamond, Hot August Night album, 1972.

Important information and disclaimer

This article has been prepared by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 (NULIS) as trustee of the MLC Super Fund ABN 70 732 426 024. The information in this article is current as at June 2021 but may cease to be accurate in the future.

NULIS is part of the group of companies comprising IOOF Holdings Ltd ABN 49 100 103 722 and its related bodies corporate (IOOF Group).

Opinions constitute our judgement at the time of preparation. In some cases information has been provided to us by third parties and while that information is believed to be accurate and reliable, its accuracy is not guaranteed in any way.

To the extent that the information in this article is or contains advice, it does not take into account any particular person’s objectives, financial situation or needs. Before acting on the information, you should consider the relevant Product Disclosure Statement, consider the product’s appropriateness to you having regard to your personal objectives, financial situation and needs, and consider obtaining independent advice. The Product Disclosure Statement for the MLC Super Fund is available at https://www.mlc.com.au/personal/superannuation/products or can be obtained by calling 132 652 (Monday to Friday between 8am and 6pm AEST/AEDT). Returns are not guaranteed and past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. You should not rely on this article to determine your personal tax obligations. Please consult a registered tax agent for this purpose. Subject to terms implied by law and which cannot be excluded, neither NULIS nor any member of the IOOF Group accepts responsibility for any loss or liability incurred by you in respect of any error, omission or misrepresentation in the information in this communication.